Enad Global 7’s Q2 2025 financials landed on Friday.

Enad Global 7

I have had an eye out for them this month because Daybreak has been in play with the who lawsuit against The Hero’s Journey pirate server. The story is pretty fraught, but one of the things that Daybreak has been claiming… beyond the obvious copyright and trademark infringement and the whole “making money off of our brand” thing that is going to win them the case… actual financial harm. The details have been redacted, but there is testimony that Daybreak fell short in Q2 2025 in part because THJ was being compared to the Fangbreaker progression server and was potentially drawing off players.

So, naturally, if you make a claim like that and you’re a publicly held company, it helps if your financial report backs that up.

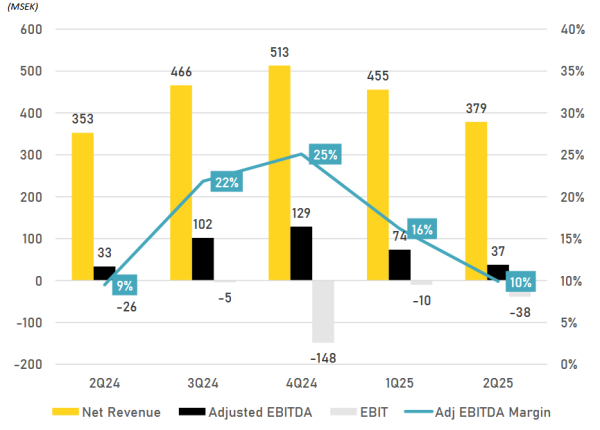

And, as it turns out, Q2 2025 was a bit of a rough quarter for EG7 overall. They highlight that things were better than in Q2 2024, so year over year improved. But that was more a matter of Q2 2024 being worse than this year being good.

EG7 Q2 2025 – Slide 6

That isn’t unusual for a software and SAAS company to have a tipping point where earnings go from breaking even to being mostly profit. That appears to have slipped down to where we’re closing in on the line between profit and loss.

At the presentation they made a pretty big deal about the wins that came with Palia, which does seem to be turning into a good investment for the company and is predicted to become the biggest revenue source for Daybreak in the future, pulling ahead of DC Universe Online and EverQuest, the long term top two for the company.

And things going well at Daybreak is kind of critical for EG7 as their live service games tend to be the consistent revenue backbone of the company. So how did Daybreak do?

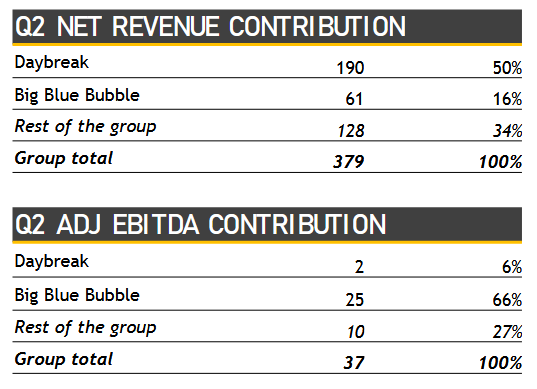

Well, it still topped revenue on the software side of the house.

Revenue Contribution Chart – Slide 8

However, the contribution to the bottom line… well, if you’re half the revenue and only 6% of the profit, that is something to look into.

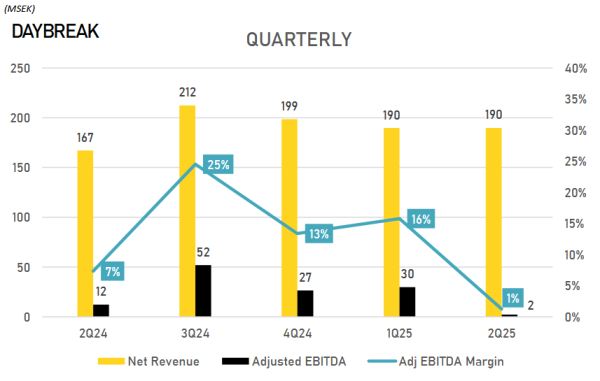

Daybreak Quarterly Numbers – Slide 8

There are two items of note on that chart.

First, growth was flat between Q1 and Q2. That does seem to support, at least superficially, the idea Daybreak expected more revenue from their Q2 special rules server, Fangbreaker, that did not appear. Correlation without proving causation, yes, but at least it is in the realm of plausibility.

In the Q&A section Acting CEO Ji Ham said this when asked about the THJ lawsuit:

Due to the live litigation, we can’t provide much detail, but EverQuest is trending below our target due to the Heroes Journey situation. We expect a court decision on the preliminary injunction in the next four to six weeks.

So maybe. We shall see what the court says. Daybreak has to get into the deep financial details before a judge, numbers that they won’t share in their public reports.

The second is, of course, WTF happened to expenses that for the same amount of gross revenue, 190 million SEK, net revenue fell from 28 million SEK to 2 million SEK? I mean, a 1% margin on software is a disaster. If Daybreak were a stand-alone public company with that result (as opposed to the company that reverse acquired EG7) shareholders would be irate and the company would be laying people off and restructuring. What made that happen?

Well, THJ didn’t do that. THJ’s impact would be at the top line, the overall revenue number. THJ isn’t likely to have done anything that had that sort of impact on expenses… except when it comes to legal fees for Daybreak. Likewise, complaints about currency fluctuations… that would hit the top line as well.

Well, what happened in Q2? Did LOTRO have to roll out new servers because their plan for the move to 64-bit was becoming something of a fiasco? I mean, they didn’t lay out any money for UI development, that is for sure. Also, something similar was going on with DDO. None of that is called out in the report, but something was costing Daybreak some money in Q2.

It could also be Palia, which did a big release on XBox and PlayStation. That always costs money in marketing and such. EG7 is hyping up the Palia acquisition. And it may in fact be making bank, but it was also clear Daybreak needed to invest in it.

So the question is whether or not this was a one time set of expenses, something that is going to hit again in Q3, or if maybe Q2 is just not a good time of the year for the company.

But the lack of mention Daybreak got in the report, outside of the focus on Palia, is worth noting. There is usually a line in there about strong franchises including EverQuest, DCUO, and H1Z1. That went missing and we haven’t heard anything about the promised revival of H1Z1 (which I always thought was a bit dubious) or that next EverQuest title.

First party game plans from Sept. 2023

This is always a problem with any plan further out that three months… the realities of the business tend to favor a different track.

Related: