Want to jump straight to the answer? The best billing and invoicing software for most people is BILL or FreshBooks

Collecting payments from clients and customers can be challenging. Ineffective invoicing systems can create serious cash flow problems—late payments stack up, follow-ups fall through the cracks, and your team spends hours on manual tasks.

For service businesses, freelancers, and B2Bs, modern billing and invoicing software automates the busywork and speeds up collections. You’ll get paid faster, reduce errors, and give customers convenient ways to pay—without adding more admin to your day.

The Top 7 Best Billing and Invoicing Software

- BILL – Best intuitive interface and automated AP/AR workflows

- FreshBooks – Best all-in-one billing and invoicing for small teams

- Square – Best for low-volume invoicing with built-in payments

- Zoho Invoice – Best free automation features

- Xero – Best invoicing inside small-business accounting

- Wave – Best forever-free invoicing and accounting

- Invoicely – Best simple billing and invoicing software

After researching and testing dozens of billing and invoicing solutions, we narrowed the field to seven standouts. Below you’ll find updated features, pricing, and use cases to help you choose confidently.

BILL – Best Intuitive Interface & Automated Workflows

BILL is a streamlined billing and invoicing platform with a clean UI that minimizes training time. It’s not a full-suite accounting tool—no payroll or inventory—but it excels at accounts payable (AP) and accounts receivable (AR) automation across approvals, payments, and collections.

On login, the dashboard summarizes upcoming due dates, overdue bills, and cash going in and out with five clear queues:

- Bills to Pay

- Open Invoices

- Bill Approvals

- Payments In

- Payments Out

The left menu houses AP/AR, vendors, customers, and reporting, while a to-do list on the right keeps priorities visible. Integrations include QuickBooks, Xero, and Oracle NetSuite, so your ledger stays in sync.

A standout time-saver is BILL’s vendor inbox. Share a custom BILL email with vendors, and invoices flow in automatically with due dates, amounts, and line items pre-captured. You just confirm the vendor, add a description, and approve. It’s ideal for multi-step approvals and audit trails.

Pricing (per user, per month): Essentials $45 · Team $55 · Corporate $79 · Enterprise custom. A 30-day risk-free trial is available.

Best for: businesses that want robust AP/AR automation and approvals without adopting a full accounting suite. Nice to have: flexible roles/permissions, audit trails, international payments, and two-way sync with leading ledgers.

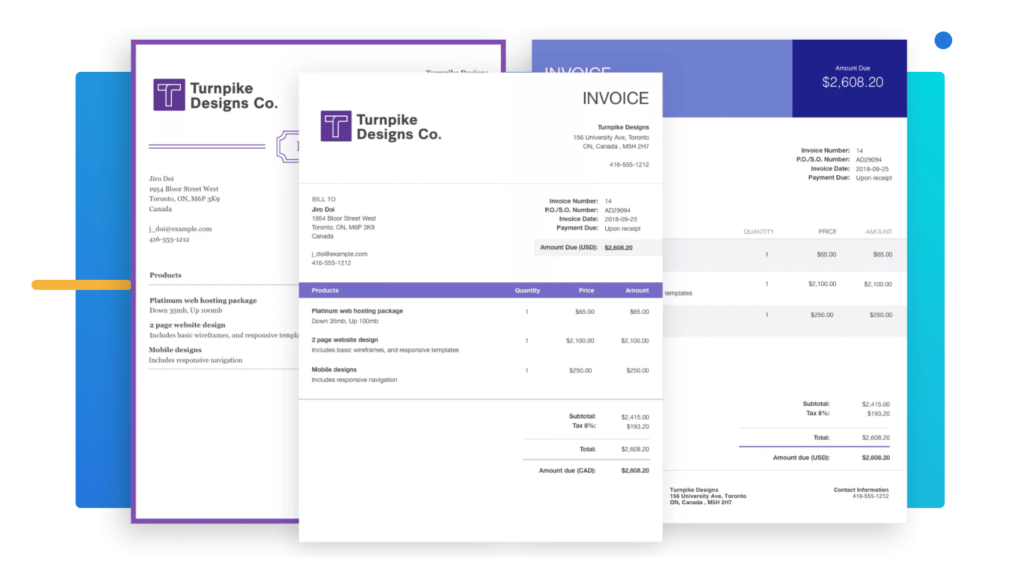

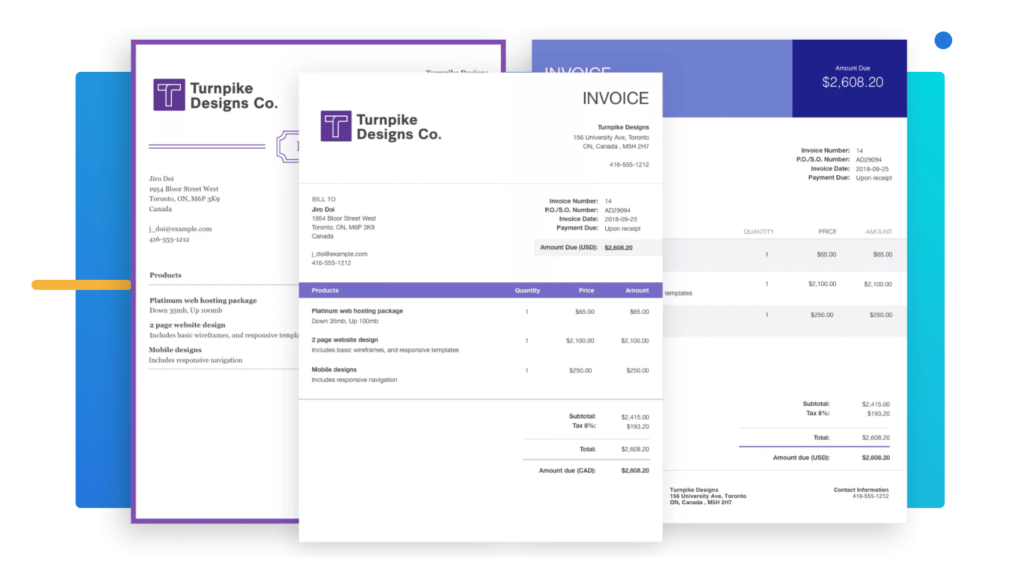

FreshBooks — Best All-in-One Billing and Invoicing Software

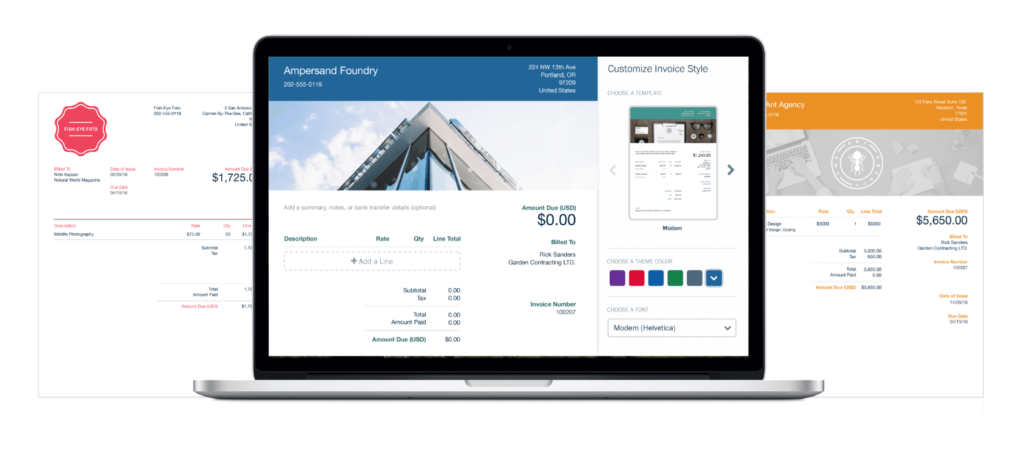

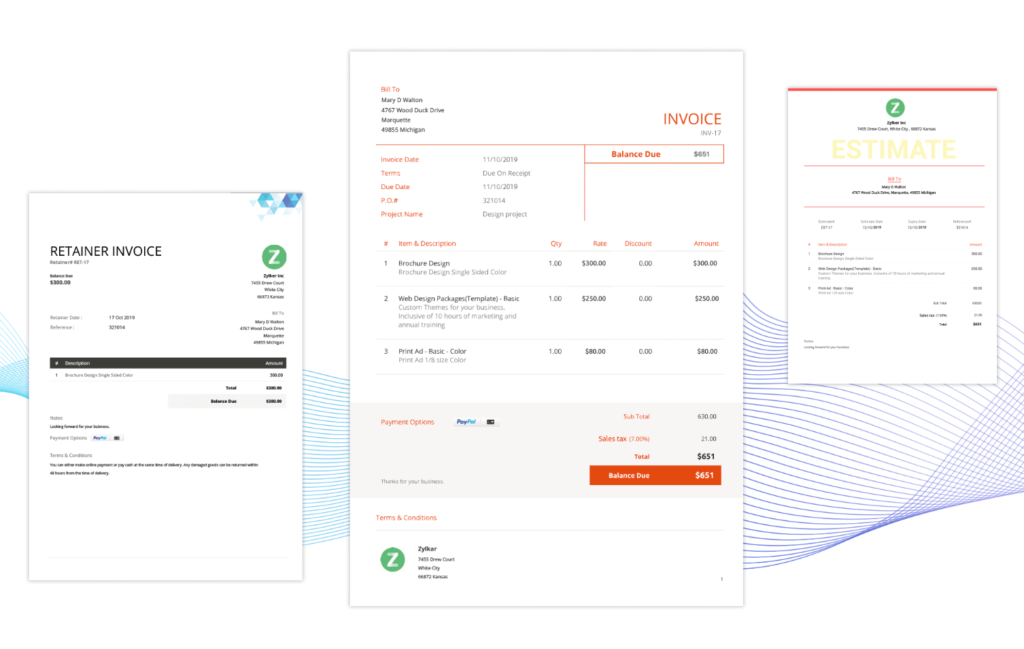

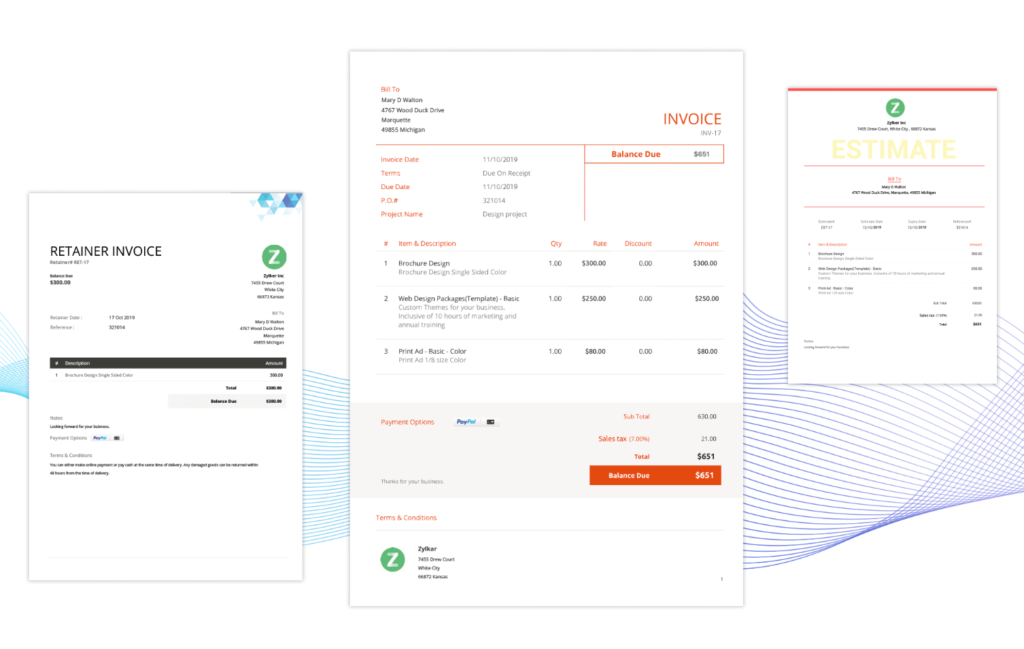

FreshBooks combines invoicing, payments, expenses, basic AP, time tracking, and simple reporting in one platform. It’s a favorite for solo pros, small agencies, and consultancies that want polished client-facing invoices without the complexity of a full ERP.

Create professional invoices in minutes—choose a template, add your logo, customize terms, and send. FreshBooks supports deposits (flat or %), credit card and ACH payments, recurring invoices, automated reminders, and configurable late fees.

Beyond invoicing, you get time tracking, expense capture, estimates and proposals, retainers, basic project tracking, and straightforward reports. It’s everything most small teams need to bill accurately and get paid quickly.

Pricing: Lite $21/month (5 billable clients), Plus $38/month (50 clients), Premium $65/month (unlimited clients), Select custom. A 30-day free trial is available; FreshBooks frequently runs seasonal discounts—check the site for current offers.

Best for: service businesses that want an easy, all-in-one billing stack with polished invoices and integrated payments.

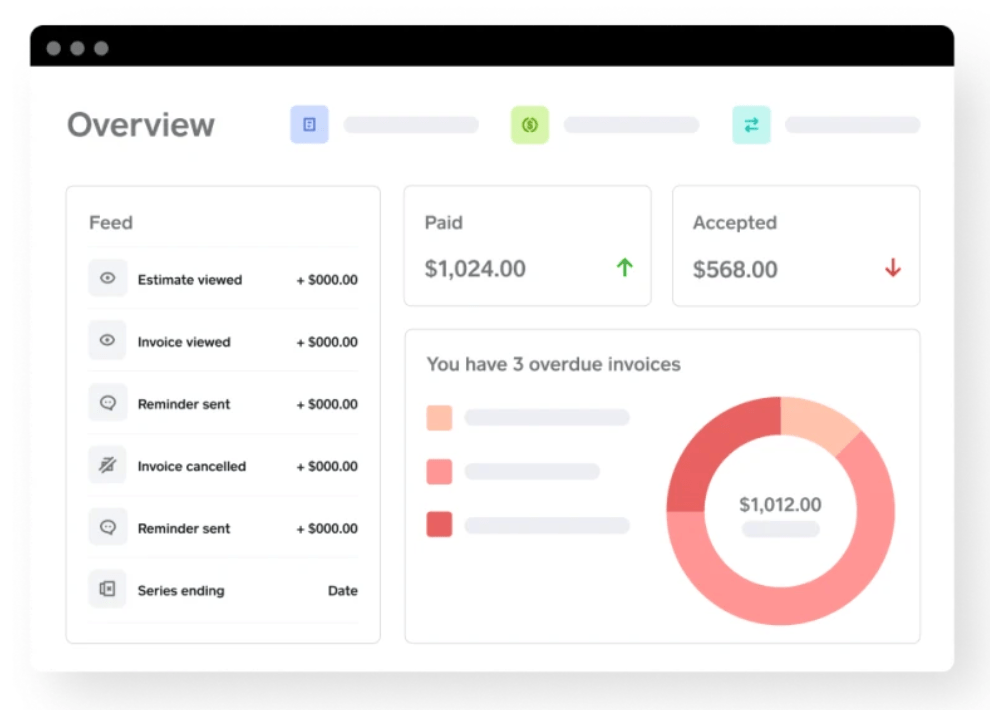

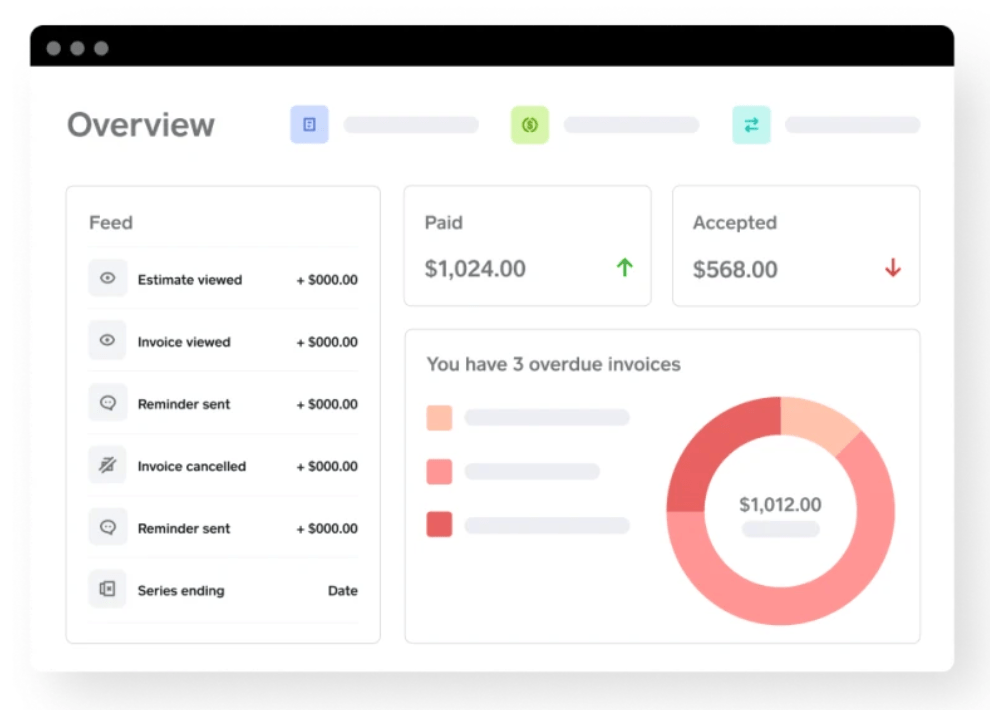

Square — Best For Low-Volume Invoicing

Square is best known for POS and card readers, but its invoicing is excellent for freelancers and trades that send a handful of invoices each month and want built-in payments.

Send digital invoices from desktop or mobile, save cards on file, set up recurring profiles, and choose from industry-specific templates. Tracking and reminders are built in, and clients can pay with a couple of clicks.

Pricing: The Free plan has no monthly fee and lets you send unlimited invoices and estimates. Standard online card processing is 3.3% + $0.30 per paid invoice; card-on-file and keyed-in payments are 3.5% + $0.15; ACH is 1% (minimum $1). Square Invoices Plus is $20/month and lowers online card processing to 2.9% + $0.30 with ACH capped at $10 per payment, plus advanced features like custom fields, batch invoicing, and multi-package estimates.

Best for: low-volume or seasonal invoicing where ease of use, client convenience, and built-in payments matter most.

Zoho Invoice — Best Automation Features

Zoho Invoice focuses purely on invoicing—and it shines. Create invoices and estimates, automate reminders and late fees, and accept payments through your preferred gateway. It’s lightweight, fast, and ideal when you don’t need a full accounting suite.

Templates cover invoices, estimates, and retainers. You can add custom fields, track tax, set up recurring billing profiles, and get read receipts when clients view an invoice—handy for follow-ups.

Extras include time tracking and expenses for accurate billing. Connect a payment gateway to take credit cards or ACH, and let the automations do the rest.

Pricing: Zoho Invoice is free.

Xero — Best Invoicing Software For Small Businesses

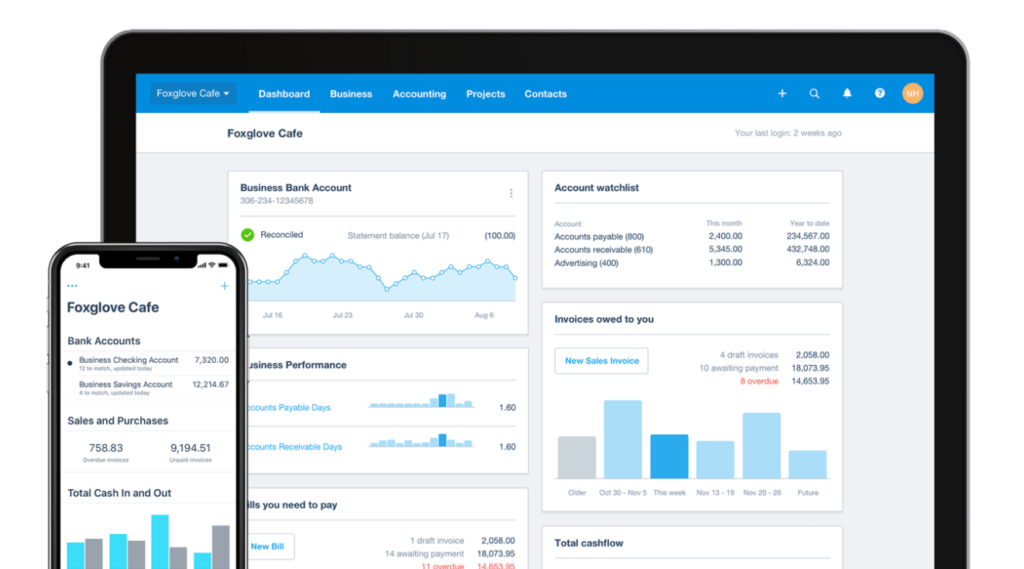

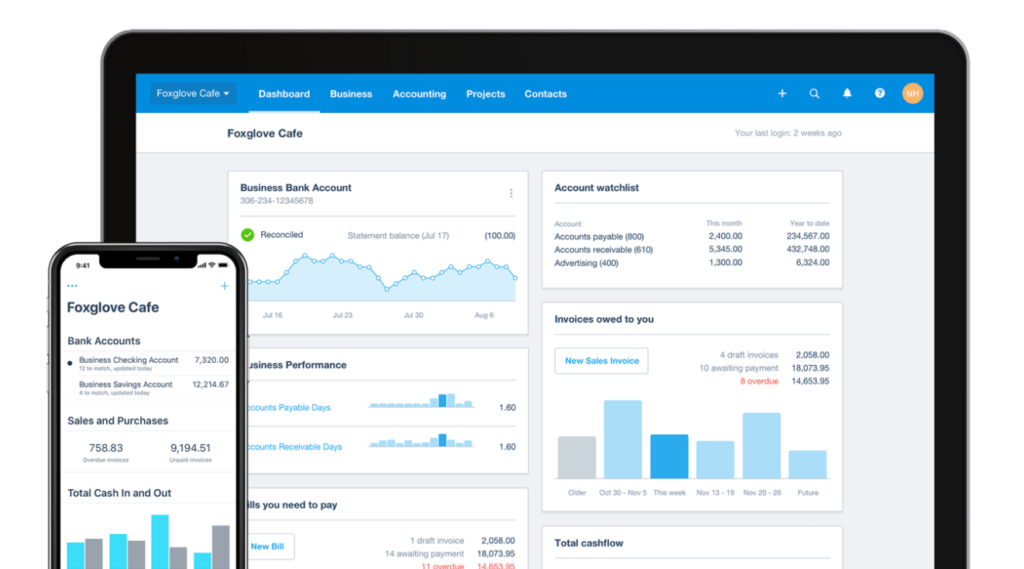

Xero is a cloud accounting platform with strong invoicing baked in. Build branded invoices, add a “Pay now” button, and accept online payments via Stripe or GoCardless. Everything syncs back to your books automatically.

Set up repeat invoices, send in bulk, replicate past invoices, and manage billing from mobile. You can also on-charge expenses, add custom payment terms, and reconcile payments quickly.

Pricing: Early — $20/month (limit 20 invoices/quotes and 5 bills per month), Growing — $47/month, Established — $80/month. A 30-day trial is available, and Xero integrates with hundreds of apps for payments, inventory, CRM, and more.

Note: Xero doesn’t include native payment processing, but connects to Stripe and GoCardless for cards, ACH, and digital wallets.

Wave — Best Free Billing and Invoicing Software

Wave offers free core invoicing and accounting—great for freelancers, very small businesses, and side hustles. Customize templates, send unlimited invoices, and manage everything from the mobile app.

Key features: multi-currency invoicing, estimates and estimate-to-invoice conversion, recurring invoices, automated reminders, partial payments, tax calculation, cash-flow insights, and mobile apps for iOS/Android.

Pricing: Core invoicing and accounting are free. If you accept online payments through Wave, standard fees apply (commonly 2.9% + $0.60 for Visa/Mastercard/Discover; 3.4% + $0.60 for Amex; ACH 1% with $1 minimum). Wave also offers an optional Pro plan billed annually that adds extras and discounted intro processing on a limited number of transactions.

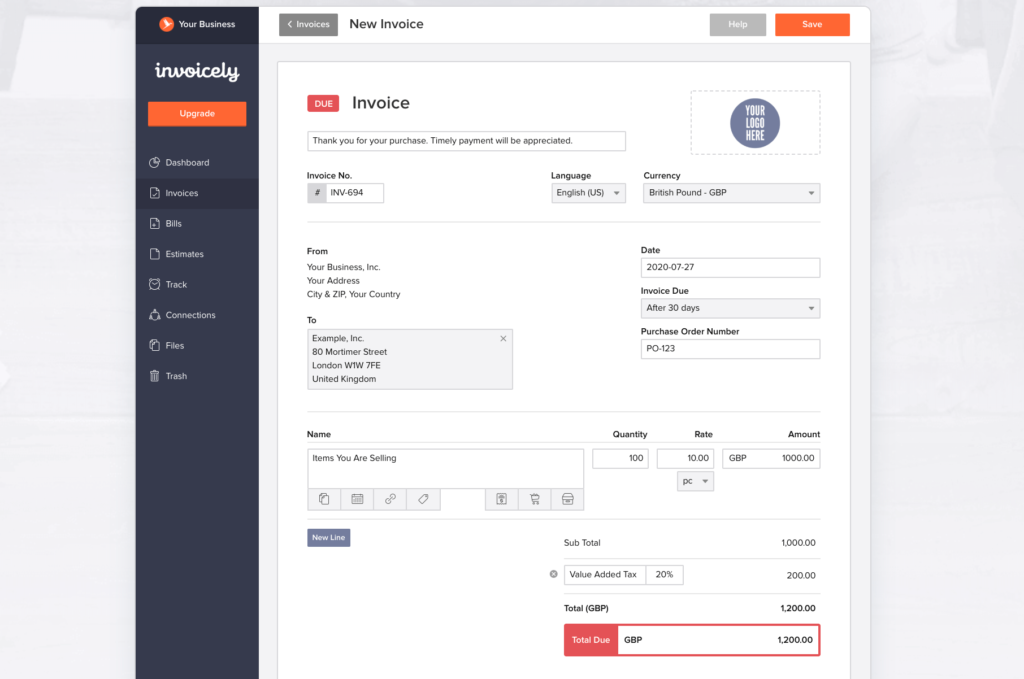

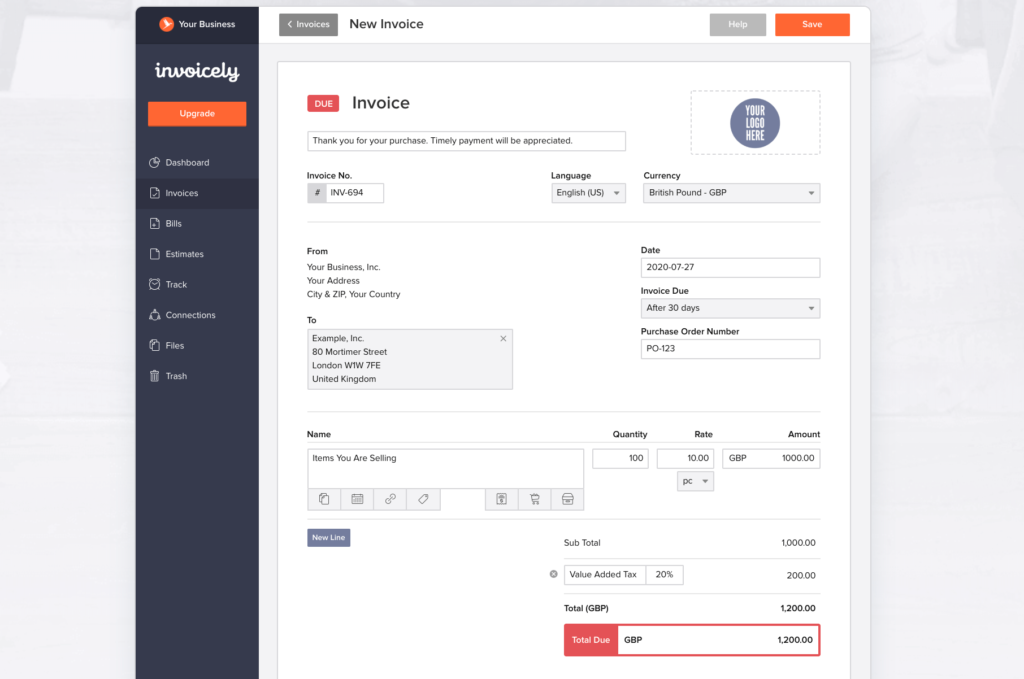

Invoicely — Best Simple Billing and Invoicing Software

Invoicely is a straightforward tool trusted by hundreds of thousands of small businesses. It favors simplicity over bells and whistles, which makes it easy to roll out and train on.

You can spin up invoices in under a minute, set up recurring statements, bill in any currency, send estimates, accept online payments, and track time, mileage, and expenses for accurate billing.

There’s a free plan for individuals, but it includes Invoicely branding, which most client-facing businesses will want to avoid.

Pricing: Basic — $9.99/month, Professional — $19.99/month, Enterprise — $29.99/month. Plans mainly differ by number of team members and invoice volume.

Best for: simple, no-frills invoicing when you don’t need a full accounting suite.

How to Find the Best Billing and Invoicing Software For You

With so many capable tools, the “best” choice depends on your clients, volume, industry, and how tightly you want billing tied to your accounting. Use the criteria below to shortlist a few options, then trial them with 2–3 real invoices to see what actually saves time.

As you compare, focus on clarity (easy to read invoices), automation (fewer clicks), and payment flexibility (easier to pay = faster cash). The right fit should lower days sales outstanding (DSO) within a month or two.

Number of Clients

How many clients do you have today—and next quarter? Tools like FreshBooks cap clients by plan (e.g., 5 on Lite, 50 on Plus), while others offer unlimited clients at every tier.

Watch for invoice or quote limits on entry plans (e.g., some “starter” tiers cap monthly invoices). If you plan to grow, choose software that won’t force an early, expensive upgrade just to send more invoices or estimates.

Bottom line: make sure your software scales with you. If in doubt, pick a plan with headroom or a provider that offers easy upgrades without downtime.

Some platforms also offer unlimited invoicing—even on free plans—so long as you’re comfortable paying per-transaction processing fees when clients pay online.

Automation

Great billing tools should remove manual work. Look for:

- Recurring invoices and retainers

- Automatic payment reminders and late fees

- Saved items/services and drag-and-drop line items

- Tax calculation and multi-currency support

- Approval workflows and roles/permissions (for teams)

Payment Collection

Sending invoices is only half of it—you still need to get paid. Many platforms include built-in processing or integrate with gateways so customers can pay by card, ACH/bank transfer, and sometimes digital wallets. Expect fees in the ballpark of ~2.9% + $0.30 for cards and ~1% for ACH, though exact rates vary by provider and plan.

Make sure you can add a “Pay now” button, store a card on file (with authorization), and set up automatic payments for recurring work. These three changes alone can shave days off your average time-to-cash.

Accounting Tools

Many invoicing platforms double as lightweight accounting (expenses, basic AP, reports). Others are part of full accounting suites with bank reconciliation, receipt capture, inventory, and project tracking. If you already have a preferred ledger, prioritize tools that sync two-ways to avoid duplicate data entry.

Examples of useful add-ons include expense management, time tracking, detailed reports, and receipt scanning. If you don’t need those, keep it simple and save money with a dedicated invoicing app.

Integrations & Ecosystem

Check that your invoicing software integrates with your accounting system, CRM, payment gateway, and project tools. A healthy app marketplace means fewer workarounds and more automation across your stack.

Security & Compliance

Look for role-based access, audit trails, and secure payment handling. If you take ACH or cards, confirm tokenization and PCI compliance through your processor. For international billing, confirm tax settings and multi-currency support.

The Top Billing and Invoicing Software in Summary

The best invoicing platforms blend automation (recurring bills, reminders, late fees), clear reporting, and convenient ways to pay. They reduce manual entry, improve accuracy, and help you track receivables at a glance.

Whether you choose the automation-first approach of BILL, the all-in-one simplicity of FreshBooks, the built-in payments of Square, or the free-forever model of Wave or Zoho Invoice, the right choice will shorten your time-to-cash and make invoicing feel effortless.